Getting My Best Investment Books To Work

Wiki Article

The ideal Investment decision Textbooks

The Greatest Guide To Best Investment Books

Interested in getting an improved investor? There are numerous guides which can help. Productive buyers read through thoroughly to build their capabilities and keep abreast of rising strategies for expense.

Interested in getting an improved investor? There are numerous guides which can help. Productive buyers read through thoroughly to build their capabilities and keep abreast of rising strategies for expense.Benjamin Graham's The Clever Investor can be an indispensable information for any investor. It handles almost everything from elementary investing procedures and possibility mitigation tactics, to price investing strategies and methods.

one. The Tiny Guide of Popular Feeling Investing by Peter Lynch

Published in 1949, this typical operate advocates the worth of investing having a margin of protection and preferring undervalued stocks. Essential-study for anybody interested in investing, specifically Individuals hunting beyond index funds to establish particular significant-value long-time period investments. Furthermore, it covers diversification principles and also how to stay away from being mislead by current market fluctuations or other Trader traps.

This guide presents an in-depth tutorial regarding how to develop into a successful trader, outlining all the ideas each trader really should know. Subjects talked about inside the ebook range from current market psychology and paper investing practices, averting prevalent pitfalls including overtrading or speculation and even more - building this ebook vital examining for major traders who would like to make certain they possess an in-depth familiarity with basic investing concepts.

Bogle wrote this comprehensive guide in 1999 to shed light to the concealed charges that exist inside mutual resources and why most buyers would benefit more from buying reduced-fee index funds. His assistance of conserving for rainy working day money whilst not inserting all of your eggs into 1 basket together with purchasing affordable index funds stays valid now as it absolutely was back again then.

Robert Kiyosaki has extended championed the significance of diversifying revenue streams through housing and dividend investments, especially real estate property and dividends. Although Prosperous Dad Weak Dad may well tumble far more into own finance than personalized improvement, Rich Dad Very poor Father remains an instructive go through for anyone wishing to higher comprehend compound curiosity and the way to make their cash perform for them instead of from them.

For a thing far more modern, JL Collins' 2019 guide can provide some A lot-needed perspective. Meant to deal with the needs of economic independence/retire early communities (FIRE), it concentrates on reaching fiscal independence by frugal living, low cost index investing as well as the four% rule - and also techniques to lessen scholar loans, spend money on ESG belongings and take advantage of on line investment decision methods.

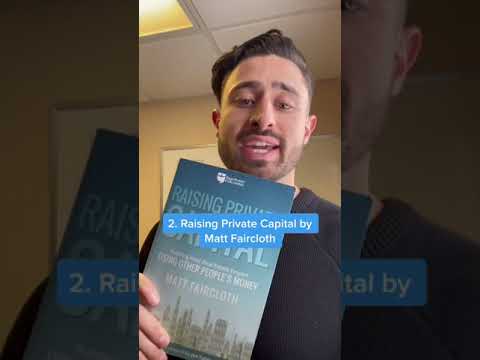

two. The Small E book of Stock Market place Investing by Benjamin Graham

Keen on investing but Not sure tips on how to progress? This e book presents practical advice prepared particularly with younger buyers in your mind, from significant pupil mortgage debt and aligning investments with personalized values, to ESG investing and on line financial means.

This finest financial commitment ebook demonstrates you ways to establish undervalued shares and produce a portfolio which will supply a regular supply of earnings. Applying an analogy from grocery buying, this finest guide discusses why it is much more prudent to not center on high-priced, nicely-marketed items but alternatively think about low-priced, ignored kinds at profits rates. On top of that, diversification, margin of safety, and prioritizing worth more than progress are all talked over extensively in the course of.

A classic in its area, this ebook explores the basics of benefit investing and the way to detect alternatives. Drawing upon his financial investment organization Gotham Cash which averaged an yearly return of 40 % all through twenty years. He emphasizes steering clear of fads though acquiring undervalued companies with robust earnings prospects and disregarding limited-term market fluctuations as significant concepts of thriving investing.

Best Investment Books - The Facts

This very best financial investment e-book's author delivers suggestions For brand new traders to steer clear of the faults most novices make and improve the return on their own money. With move-by-move Guidance on creating a portfolio designed to steadily increase with time as well as writer highlighting source why index money offer probably the most economical implies of financial commitment, it teaches readers how to take care of their program no matter current market fluctuations.

This very best financial investment e-book's author delivers suggestions For brand new traders to steer clear of the faults most novices make and improve the return on their own money. With move-by-move Guidance on creating a portfolio designed to steadily increase with time as well as writer highlighting source why index money offer probably the most economical implies of financial commitment, it teaches readers how to take care of their program no matter current market fluctuations.Fascination About Best Investment Books

While initially released in 1923, this guide stays an priceless guideline for any person interested in controlling their finances and investing correctly. It chronicles Jesse Livermore's encounters - who attained and shed hundreds of thousands around his lifetime - while highlighting the importance of chance idea as part of final decision-earning processes.

While initially released in 1923, this guide stays an priceless guideline for any person interested in controlling their finances and investing correctly. It chronicles Jesse Livermore's encounters - who attained and shed hundreds of thousands around his lifetime - while highlighting the importance of chance idea as part of final decision-earning processes.If you're trying to find to improve your investing abilities, there are many excellent textbooks out there that you should pick. But with limited several hours in each day and restricted readily available reading content, prioritizing only those insights which offer the most benefit is often difficult - And that's why the Blinkist app delivers these easy access. By amassing critical insights from nonfiction publications into Chunk-sized explainers.

3. check here The Minor Guide of Worth Investing by Robert Kiyosaki

This ebook handles investing in organizations with an financial moat - or aggressive edge - such as an economic moat. The writer describes what an economic moat is and gives samples of a lot of the most renowned firms with 1. On top of that, this ebook details how to find out a company's price and buy shares In line with selling price-earnings ratio - perfect for novice traders or any person desirous to master the basics of investing.

This doorstop expense ebook is the two well known and thorough. It handles many of the greatest techniques of investing, which include beginning youthful, diversifying extensively and not paying out significant broker service fees. Created in an interesting "kick up your butt" type which can possibly endear it to audience or convert you off wholly; while masking several widespread pieces of advice (invest early when Other individuals are greedy; be wary when Other folks turn out to be overexuberant), this textual content also endorses an click here indexing approach which heavily emphasizes bonds when compared with a lot of equivalent tactics.

This e book provides an insightful approach for inventory selecting. The creator describes how to choose successful stocks by classifying them into 6 distinct types - gradual growers, stalwarts, fast growers, cyclical shares, turnarounds and asset performs. By following this clear-cut process you enhance your odds of beating the market.

Peter Lynch is one of the entire world's Leading fund supervisors, acquiring operate Fidelity's Magellan Fund for thirteen decades with a mean return that beat the S&P Index yearly. Printed in 2000, his e book highlights Lynch's philosophy for choosing shares for specific investors within an obtainable fashion that stands in stark distinction to Wall Road's arrogant and overly specialized approach.

Warren Buffett, one of several richest Males on the planet, has an uncanny ability to think logically. This book, at first created as letters to his daughter, contains useful and clever assistance on producing the stock market give you the results you want - with its most famous tip being purchasing undervalued belongings for greater than their intrinsic worth - delivering newcomers to investing with an excellent Basis in investing and knowledgeable kinds with beneficial suggestions to really make it profitable. This is among the finest publications to Keep reading investing.

4. The Very little Reserve of Inventory Marketplace Buying and selling by Mathew R. Kratter

If you want to attain inventory marketplace investing experience and extend your individual portfolio, this guide delivers a super spot to begin. It explains how to choose stocks with robust development opportunity though educating you about examining businesses - and also encouraging inexperienced persons steer clear of typical problems they regularly make. In addition, its very clear and easy language make for a nice looking through practical experience.

Benjamin Graham is referred to as The daddy of value investing, an strategy centered on acquiring excellent shares at low rates. He wrote two books on investing; Security Assessment is his signature work describing his conservative, value-oriented method - it has even been advisable by top rated traders including Invoice Ackman and John Griffin!